Drawer On A Cheque

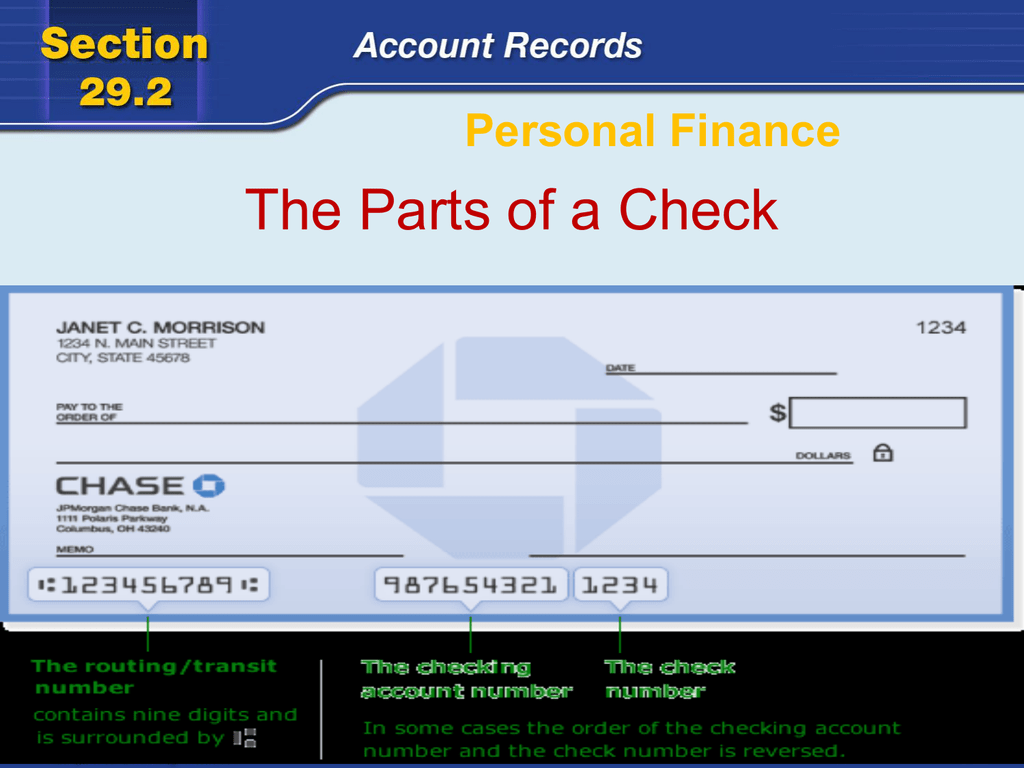

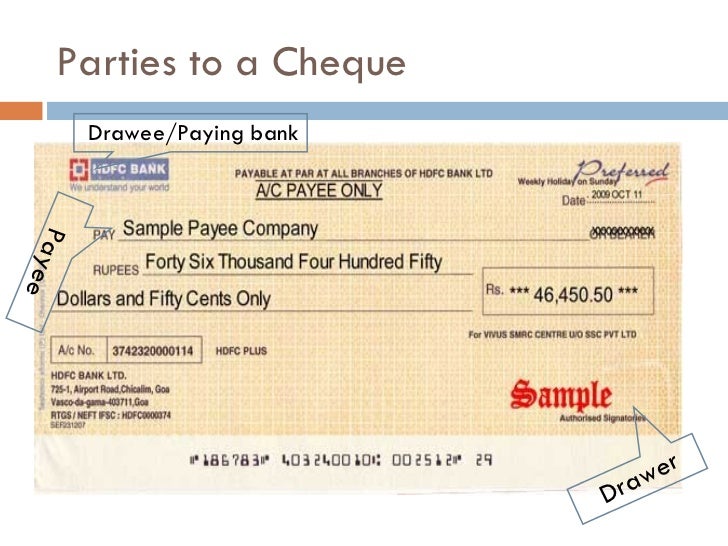

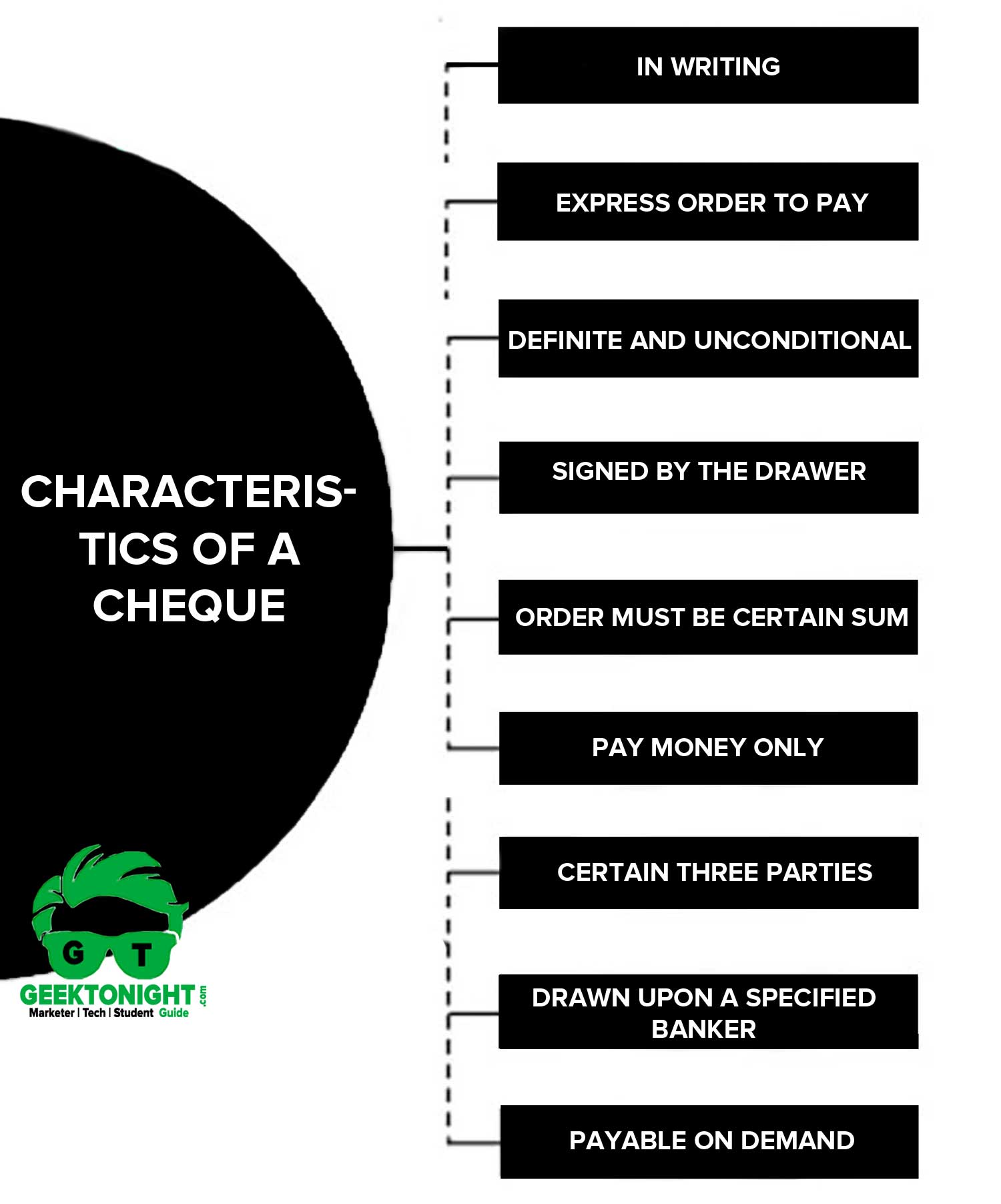

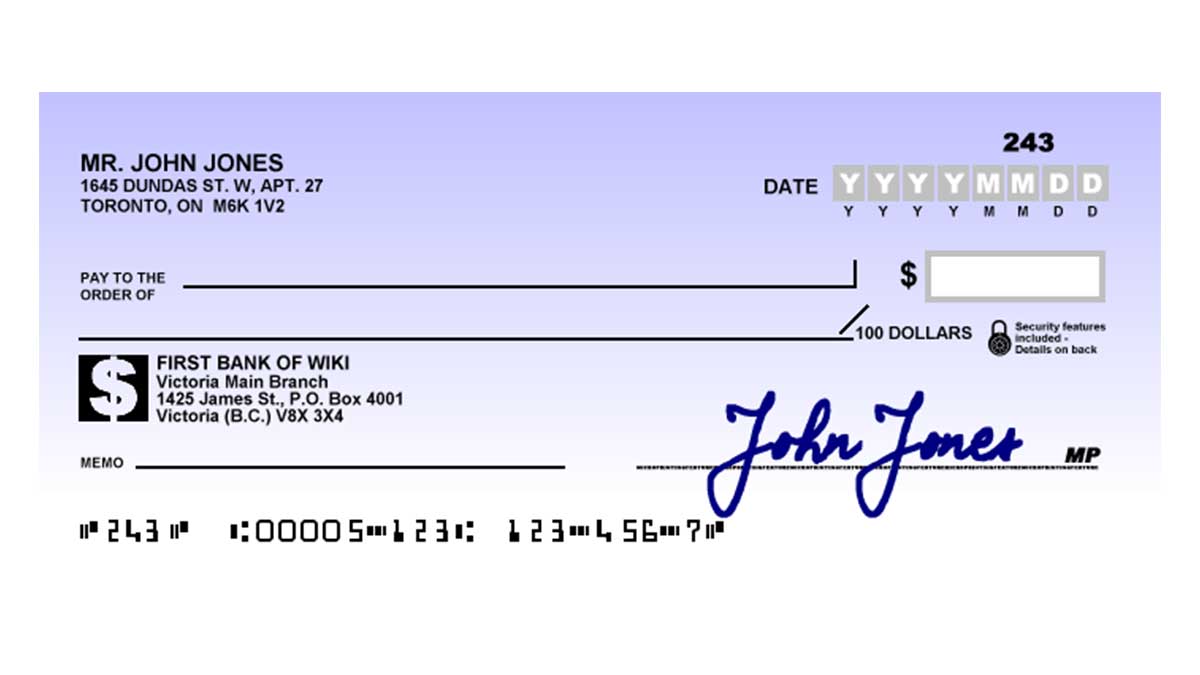

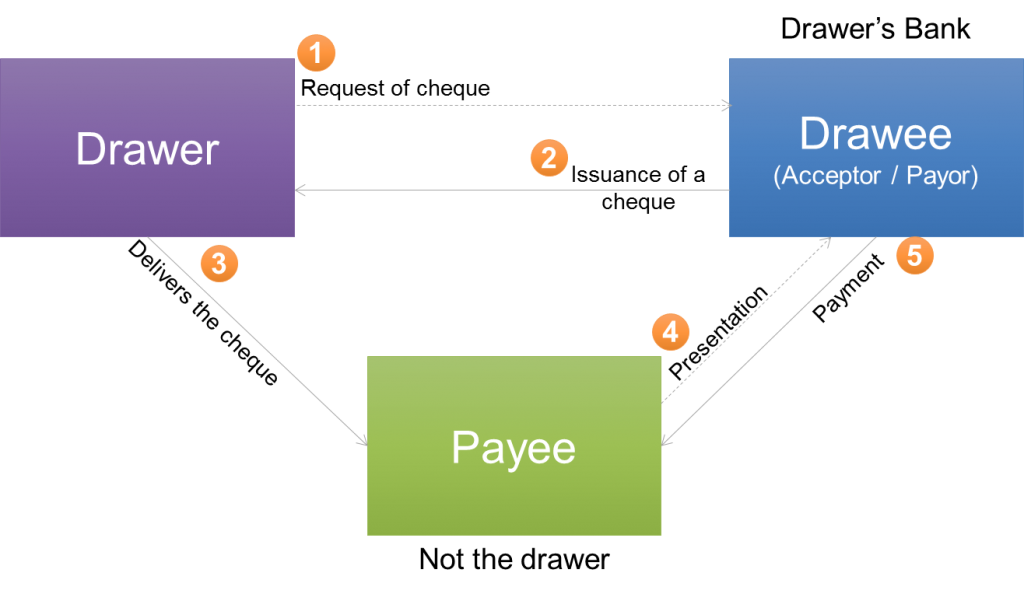

Drawer On A Cheque - In such transactions drawer is the. Most often, if you deposit a check,. Web stop payment orders: The drawee, on the other hand, is the bank on which the. Your signature as the drawer of the cheque. The person thereby directed to pay is called the “drawee”. Apart from these, there can also be a payee who is liable to pay the amount on the cheque. The drawer’s order to the drawee bank must be unconditional and should not make the cheque payable dependent on a contingency. It is the bank which is ordered to pay the amount mentioned in the cheque. Web a cheque can be drawn on a bank where the drawer has an account, saving bank, or current. Web stop payment orders: Apart from these three, there are two more parties to a cheque: These include the drawer and the drawee. The person who draws the cheque, i.e. A cheque cannot be drawn so as to be payable conditionally. The person who draws the cheque, i.e. The person thereby directed to pay is called the “drawee”. While the drawer is the person who draws the cheque, the drawee is the banker on whom it is drawn. Web a drawee is the person or entity that pays the holder of a check or draft. Web a drawee refers to the. The drawer is the account holder from where the cash is to be transferred. Why you should understand a check's format The maker of a bill of exchange or cheque is called the “drawer”; Payee is the person in whose name the cheque is issued. Your signature as the drawer of the cheque. Apart from these three, there are two more parties to a cheque: If the drawer stops payment on a cheque without a valid reason (e.g., fraud or dispute), they could be liable for damages to the payee. He/she is the person who has the bank account and issues (draws) the cheque for making payment. The drawee of a check is.. They are drawer, drawee, and payee. It contains an unconditional order to pay: In a financial transaction, a drawee typically serves as an intermediary. Web drawer is the person who writes and issues the cheque. Web in a cheque transaction, three parties are involved namely, the drawer, the drawee, and the beneficiary or payee. A cheque cannot be drawn so as to be payable conditionally. The person or entity who is to be paid the amount. Usually, the drawer's name and account is preprinted on the cheque, and the drawer is usually the signatory. A cheque must contain all the characteristics of a bill of exchange. The person or entity whose transaction account is. It represents the bank that will make the payment. Your signature as the drawer of the cheque. Web the drawer, the drawee and the payee. Bearer cheque vs order cheque comparison chart what is bearer cheque? Signs and orders the bank to pay the sum. They are drawer, drawee, and payee. Web the person writing the cheque, known as the drawer, has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. Web the person or entity writing the check is known as the payor or drawer, while the person to whom the check is. The person or entity whose transaction account is to be drawn. Web drawer is the person who writes and issues the cheque. He/she is the person who has the bank account and issues (draws) the cheque for making payment. The person or entity who is to be paid the amount. Apart from these, there can also be a payee who. Each cheque has a different number for identification purposes. His signature on the check authorizes his banker to make payment. It may only be cashed in the drawer’s bank. Drawee is the bank in which drawer holds and on which he draws his cheque. In such transactions drawer is the. Web a senate staffer is out of a job after the publication of a video appearing to show two men having sex in a senate hearing room. Apart from these three, there are two more parties to a cheque: It contains an unconditional order to pay: He is the customer and account holder of the bank. It represents the bank that will make the payment. On the cheque, the term “self” would be used in place of the drawee’s name. It may only be cashed in the drawer’s bank. Web the person writing the cheque, known as the drawer, has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawee, on the other hand, is the bank on which the. Your signature as the drawer of the cheque. Web drawer is the person who writes and issues the cheque. If the drawer stops payment on a cheque without a valid reason (e.g., fraud or dispute), they could be liable for damages to the payee. The drawer is the person whose signature appears on the check. It is the bank which is ordered to pay the amount mentioned in the cheque. The drawee of a check is. The person or entity who is to be paid the amount.Design 40 of Who Is The Drawer Of A Bank Cheque valleyinspectionspestinc

Drawer Drawee Payee Example Bruin Blog

10 Essential elements characteristics of cheque by Techy Khushi Medium

Drawer And Drawee Of A Cheque Bruin Blog

Drawer And Drawee Of A Cheque Bruin Blog

How to Write a Check 6 Simple Steps and Examples phroogal

Drawer And Drawee Of A Cheque Bruin Blog

Drawer And Drawee Of A Cheque Bruin Blog

How to Write a Check Cheque Writing 101

Drawer And Drawee Of A Cheque Bruin Blog

A Cheque Cannot Be Drawn So As To Be Payable Conditionally.

The Only Requirement Of The Cheque Is To Have A Micr Code Encoded In The Cheque For The Clearinghouse To Properly Handle The Cheque.

His Signature On The Check Authorizes His Banker To Make Payment.

The Maker Of A Bill Of Exchange Or Cheque Is Called The “Drawer”;

Related Post: