Income Tax Drawings

Income Tax Drawings - A drawing account is used primarily for businesses that are taxed. An owner’s draw is not taxable on the business’s income. Web the specific tax implications for an owner's draw depend on the amount received, the business structure, and any state tax rules that may apply. Drawing of the income tax stock illustrations Specifically, you want to use the net profit from line 31 and divide that 12 to get an average monthly net profit. Arizona has been one of the fastest growing states in recent years, as low taxes may have played a role in drawing people to the desert. Web there are seven federal income tax rates in 2023: In this post, we’ll look at a few different ways small business owners pay themselves, and which method is right for you. However, a draw is taxable as income on the owner’s personal tax return. Web because the majority of your income is untaxed, you are going to want to set aside a percentage of your gross income so that you're not slammed all at once when april rolls around. Web the seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Specifically, you want to use the net profit from line 31 and divide that 12 to get an average monthly net profit. Drawings is money you borrow from the company. You’ll need to use the information from your income tax. Web the federal government uses a progressive tax system, which means how much income tax you pay as an individual or a couple depends on how much taxable income you earn; Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows; Web in a sole trader or partnership structure, money taken from the business. Web there are seven federal income tax rates in 2023: (paying tax via the bank) income tax account. Income tax groupings specified by the internal revenue service (irs) that determine at what rate an individual, trust, or corporation's annual income will be subject to. Web the federal government uses a progressive tax system, which means how much income tax you. Web for information on an award you received from a foreign source, see publication 525, taxable and nontaxable income. Web if the amount on line 5 is $100,000 or more, use the tax computation worksheet 14. Avoiding unrelated business income tax;. Be prepared to set aside up to a third of your income for taxes. Hand with pen can be. In most cases, the taxes on an owner’s draw are not due from the business, but instead the income is reported on the owner's personal tax return. Specifically, you want to use the net profit from line 31 and divide that 12 to get an average monthly net profit. Swirly doodles and lined paper are on layers that can be. Call to schedule your appointment ahead of time. Drawings is money you borrow from the company. Web prepare for your appointment. Web the federal government uses a progressive tax system, which means how much income tax you pay as an individual or a couple depends on how much taxable income you earn; Journal entry for income tax in case of. Add lines 18, 21, and 22 15. Income tax groupings specified by the internal revenue service (irs) that determine at what rate an individual, trust, or corporation's annual income will be subject to. Swirly doodles and lined paper are on layers that can be easily removed. Arizona has been one of the fastest growing states in recent years, as low. Web november 19, 2021 if you're the owner of a company, you’re probably getting paid somehow. Web the specific tax implications for an owner's draw depend on the amount received, the business structure, and any state tax rules that may apply. Web federal tax brackets: Web a drawing account is an accounting record maintained to track money and other assets. Income tax groupings specified by the internal revenue service (irs) that determine at what rate an individual, trust, or corporation's annual income will be subject to. Figure the tax on the amount on line 1. Web for information on an award you received from a foreign source, see publication 525, taxable and nontaxable income. Web there are seven federal income. A drawing account is used primarily for businesses that are taxed. A shareholder's salary is your share of the company's profits for work you do in the business. (paying tax via the bank) income tax account. Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows; Your bracket depends on your taxable income and. Arizona has been one of the fastest growing states in recent years, as low taxes may have played a role in drawing people to the desert. Call to schedule your appointment ahead of time. Web the specific tax implications for an owner's draw depend on the amount received, the business structure, and any state tax rules that may apply. Learn more salary method vs. Hand with pen can be moved to any position and drawing underneath it is complete. Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows; Add lines 18, 21, and 22 15. You pay tax on your shareholders salary. How much money depends on where you live, so look up what percentage of your income you'll owe. A shareholder's salary is your share of the company's profits for work you do in the business. However, a draw is taxable as income on the owner’s personal tax return. The tool is designed for taxpayers who were u.s. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. A taxpayer identification number, such as a social security number. Web at the end of the year, your taxable income would be $40,000 — the profits from the business, which your draws won’t reduce. View a gallery of tax cartoons, including cartoons on income taxes, the irs, tax day, and other funny cartoons about paying taxes.![]()

icono de impuestos. Doodle dibujado a mano o estilo de icono de

Tax Doodle Stock Illustration Download Image Now iStock

Tax Cartoon, c1915 Drawing by Oscar Edward Cesare Fine Art America

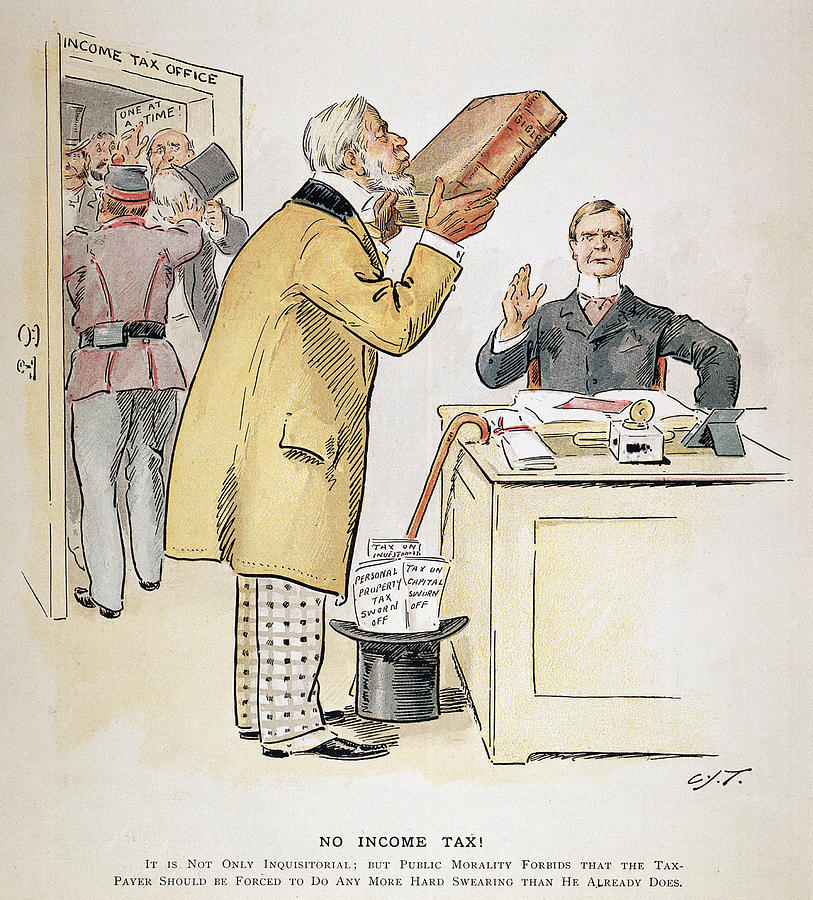

Tax Cartoon, 1894 Painting by Granger Pixels

Tax. Cute cartoon doodle illustration. 629013 Vector Art at Vecteezy

I dug up this tax drawing from 4 years ago, when I was studying for

Artistic drawing of 1040 individual tax Vector Image

Tax Illustration Vector Vector Art & Graphics

Tax Vector Art Vector Art & Graphics

Woman taxes bills pencil stock illustration. Illustration of figures

Web Because The Majority Of Your Income Is Untaxed, You Are Going To Want To Set Aside A Percentage Of Your Gross Income So That You're Not Slammed All At Once When April Rolls Around.

Any Tax Documents You’ll Need.

Web If The Amount On Line 5 Is $100,000 Or More, Use The Tax Computation Worksheet 14.

It's A Way For Them To Pay Themselves Instead Of Taking A Salary.

Related Post: